The marathon renewable energy assets have been running for more than a decade seems to be approaching the finish line. Where we started off with handmade #gogreen slogans, and a wishlist of subsidies; today, clean energy asset management has come a long way. Hence, it has become competitive enough to add subsidy independence to its ever-growing list of strengths.

Across the world, renewable energy assets are being deployed with or without subsidy brackets. Now, this isn’t to say that all quotas and tax breaks have been useless. In fact, we want to assert is that the policy push renewables needed in their early days has fulfilled its goal.

Today, developers are basing new solar projects in sunny Italian regions solely on performance and optimization. And in China, the government’s mandate to pause financial support for solar and wind is on the table.

We’d say we saw it coming. Energy asset management is on a roll. But sure, let’s be objective and analyze some numbers.

For one, corporate power purchase agreements (PPAs) saw a record high of 19.5GW in 2019. Within these, 80% came from Virtual PPAs – a trend that strongly supports the transition of renewable energy asset management into a streamlined discipline.

Second, the renewable energy asset management industry now employs more than 10 million people globally. The industry has grown exponentially, becoming a primary source of income for thousands of families. Hence, there’s been marked growth in this sector that speaks volumes for its demand, regardless of subsidy renewals and extensions.

Consequently, put all these trends in perspective – in the face of dwindling Investment and Production Tax Credits, and against an opponent that relies on a minimum of $20 billion subsidies per year.

Impressive, eh?

Plummeting Costs & Better Technologies for Energy Asset Management

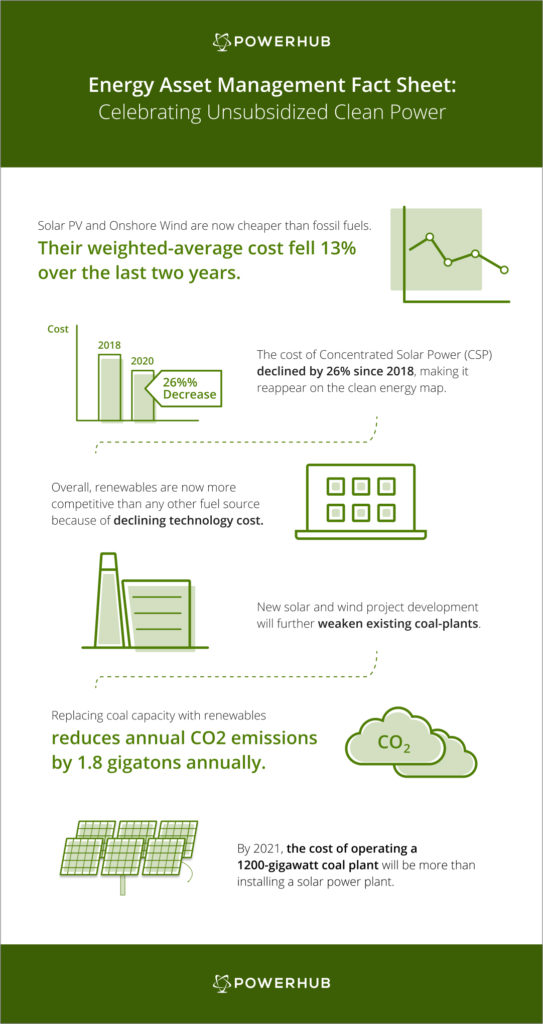

While there is plenty of data that points in this direction, a recent report by the International Renewable Energy Agency (IRENA) solidifies this achievement. And the golden words? Unsubsidized clean power – now that’s music to our ears.

Here’s what we find note-worthy about unsubsidized renewable power:

Aligning Energy Costs with Subsidy Independence

Traditionally, investors have always analyzed renewable energy assets critically. They perceived clean power to be a risky investment because of massive CAPEX costs – an important component that eventually translated into high lending rates. However, as we mentioned, the past decade has truly been a transformational journey.

Today, an investor-ready clean energy portfolio is made up of electricity sources that are the cheapest in at least two-thirds of the world. According to analysts at BloombergNEF, the per megawatt-hour cost of the most innovative solar and wind projects will go below $20 by 2030. What was this cost some 10 years back? $300 for solar, and $100 for onshore wind.

This steep decline reflects incremental changes in energy asset management technology that have been tried & tested over the years. Take wind projects, for instance. Sharper blades, taller towers, and gearless technologies have made wind turbines 28% cheaper.

While these changes may be seemingly unnoticeable, they’ve transformed 80-feet tall, 25KW machines to mammoth towers with 12MW capacities, and remote digital controls.

Similarly, PV panels – one of the most resilient renewable energy assets – have seen a cost decline of 82% between 2010 and 2019. Producing power through raging temperatures of the Sahara desert, or Cat-5 hurricanes of the Bahamas – they’ve easily become the backbone of renewables.

The Way Forward

There’s a bunch of factors that have given renewable energy a level playing field. One that we talk about often is collaboration. It’s apparent that cities, states, communities, and developers have joined hands to work towards a common goal.

They all want clean power to be the power of choice.