With the clean power sector entering the maturity stage, renewable energy investments and innovations have become interesting topics. As we read news after news about the plummeting cost of solar and wind projects, the big question that pops up is ‘what does the world of renewable investments look like right now?’

One wonders, is this sector innovating enough to attract thriving investments? Or better yet, is there even a link between the two? Let’s try to figure out how close we might be to a clean powered world with an analysis of these questions.

Renewable Energy Investment and Innovation Go Hand in Hand

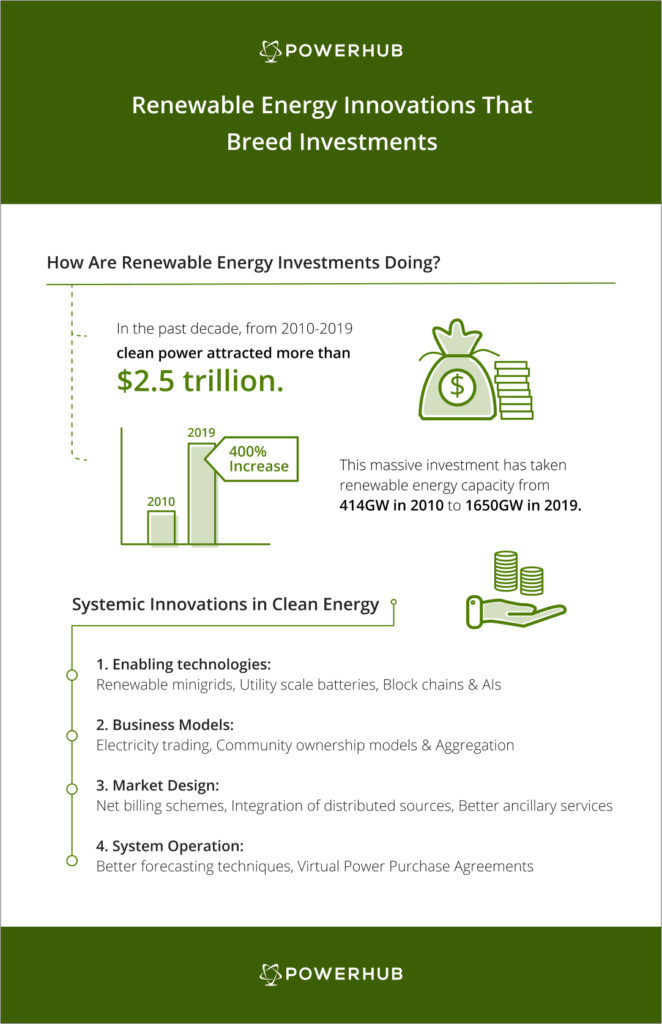

Renewables are a lucrative industry. A comprehensive analysis published in the Global Trends in Renewable Energy Investment 2019 report confirms this notion. Their findings suggest that in the past decade, from 2010-2019, clean power attracted more than $2.5 trillion.

Coupled with the most prominent trends in clean power, this massive investment has taken renewable energy capacity from 414GW in 2010 to 1650GW in 2019. But what made this possible? What compelled multimillion-dollar companies to invest in clean power? And what makes such investment profitable?

There’s only one answer, and tons of data to support it. Innovation.

The International Renewable Energy Agency (IRENA) asserts in its 2019 report that the ‘innovation landscape for a renewable-powered future is necessary for a smooth transition from traditional power.’

Hence, it categorizes various types of innovations seen in this industry in the past decade. The following four classifications of innovations have bred investments in this sector.

The report is a compilation of global developments that have fed into an environment of Systemic Innovation. According to this concept, the above innovations have not come about in isolation. Instead, a combination of global factors and trends like climate change, borderless management, and stronger aggregation have worked towards it.

Therefore, it’s undeniable that renewable energy investment and innovation go hand in hand. This link needs to be stronger than ever right now. As Inger Anderson, Executive Director of the UN Environment Program puts it.

And the Way Forward for Renewable Energy Investment and Innovation?

So, will renewables garner as much investment as they did in the growth phase? Well, like any other business model, the maturity period does see a slowdown in investment. A number of experts have expressed concern over this link between renewable energy investments and innovations.

Nonetheless, if this were the traditional energy sector, such a ‘normal’ trajectory may not be a problem. For the green counterparts, however, this may not be good news. Renewable energy has a marathon to win. To reduce CO2 emissions, and keep global temperature rise below 2 degrees as per the Paris Climate Agreement.

Hence, we need to ensure that renewable energy investment and innovations will stay on track. And for that, we need a shift in incentives and perspectives. Incoherent policies, risky regional investment conditions, and misalignment in various electricity markets around the world are just some of the major reasons for a potential slowdown in investments.

There’s really no room for these administrative worries if we are to further the Majority Renewables Agenda.

No doubt, change has to come from government authorities and policymakers. And a careful analysis of strategies like FiT (feed-in-tariffs), public tendering, auctions, and low-carbon investments should be called for.

For investments in renewables to power through, all stakeholders involved should ideally work towards a common goal.

Investor-Ready Portfolio – A Framework of Transparency and Collaboration

Therefore, an investor–ready portfolio leverages the efficiencies resulting from smart asset management. Only when there’s transparency, collaboration, and well-oiled platform integrations, will wind and solar projects tick all boxes on an investor’s checklist.

Our Director of Sales & Strategic Partnerships has written extensively about cultivating a crisis-proof management style – an essential as we make the leap towards virtual and borderless energy trading.

Needless to say, such resilience in an investor ready portfolio can be induced by an intelligent renewable asset management platform. One that strengths the ties between renewable energy innovations and investments at every stage of development.

That’s our ticket to a clean powered world.