These days, popular opinion in renewable circles is that the baton for clean power is now in the hands of energy asset management companies. The global demand for renewables is on the rise, with a strong focus on ‘majority renewables’ in the next 10 years.

What will make this aspirational aim a reality is the formal structure and coordinated approach that asset management companies bring with them. On a more granular level, they help the renewable energy industry tackle a deeply ingrained problem: lack of transparency.

Large-scale utilities have multiple projects and teams on board, go through multiple hand-offs, and usually have a ton of contractual obligations. Consequently, with all this complexity, and a manual management style in the mix, process and data transparency usually takes a back seat.

Therefore, as an energy asset management company, we always tell our clients there’s a strong relationship between digitalization and transparency. A coordinated digital strategy opens doors to better communication and analysis simply because it makes information accessible.

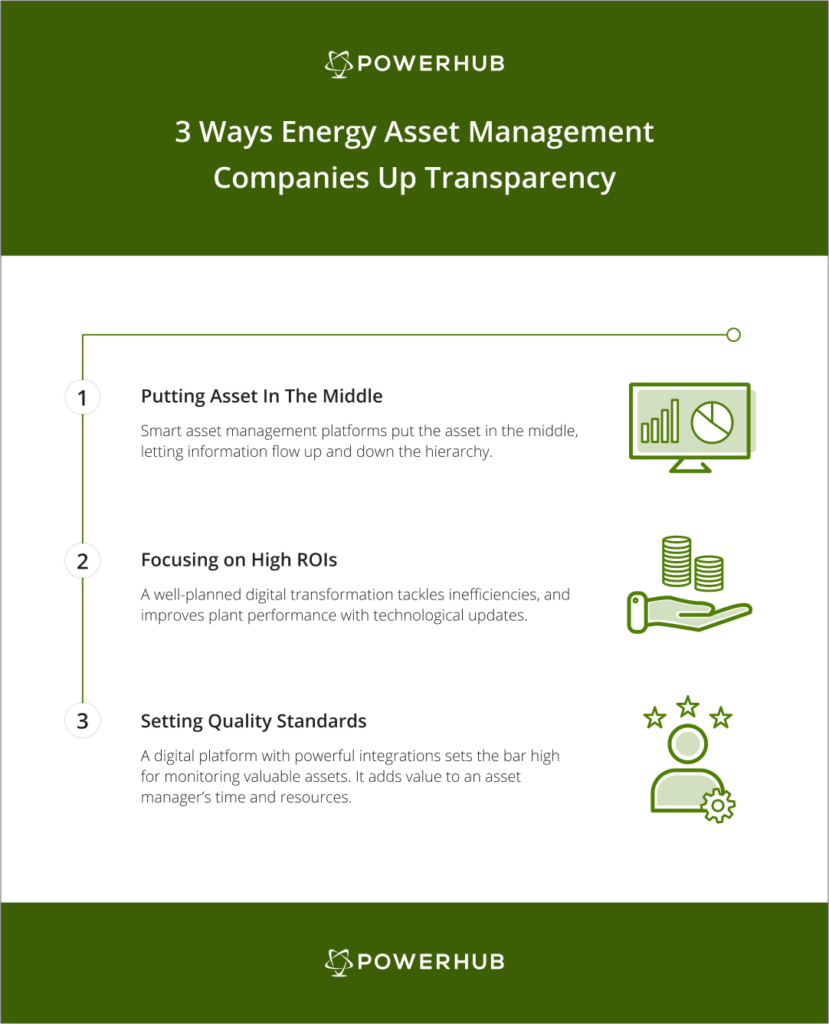

3 Ways Energy Asset Management Companies Up Transparency

Introducing an Asset Centric Approach

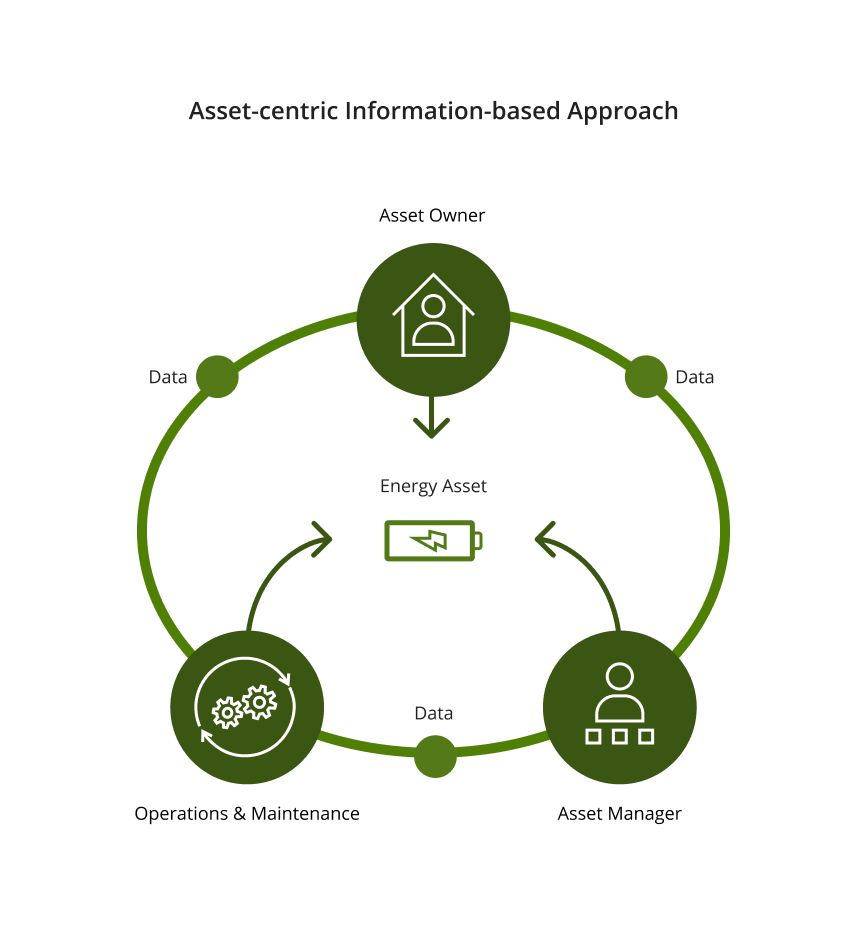

Traditionally, companies approached renewable energy assets linearly. They performed a function. The O&M contractor gathered data, passed it along to the asset manager, and then presented it to the asset owner. The process was fairly simple. And drew a straight line of command. Instructions trickled down and reports were sent up the hierarchy.

However, it hindered transparency because the asset owner could hardly access data before it was filtered. With smart digital platforms, energy asset management companies broke this pyramid – making way for two-way communication, and most of all, increased transparency.

Digital tools have introduced an asset-centric approach to managing solar and wind plants. With this management style, all data and decisions are based around the asset, and are available at a central node. Any stakeholder, at any level of energy production, can access them in real-time.

Focusing on Higher Returns on Investment

Return on Investment is one of the most crucial subjects in clean power. Partly because this industry has long been challenged by the non-green counterpart to prove its profitability. Well, renewable sources do generate ROIs, and energy asset management companies play a key role in maximizing them.

In this regard, asset managers prioritize cost reduction and improving plant performance with technological upgrades. And nothing can tackle these challenges better than a well-planned software adoption strategy.

As we always say at PowerHub, the digitalization process is a journey. It takes the guesswork out of managing plants by equipping all stakeholders with insights on performance, maintenance schedules, and the overall health of renewable energy assets.

The result? Optimal asset performance and high returns on investment.

Setting High Quality Standards

Gone are the days of saving up costs with manual energy asset management. Today, successful renewable energy projects are proof that the focus has shifted to implementing quality standards and protocols.

A digital platform with powerful integrations sets the bar high for monitoring valuable assets. Hence, it adds value to an asset manager’s time and helps him track everything on a single software.

And we know very well that with high-quality standards, comes a greater need to report and account for variances. These activities help improve transparency, especially when managing large, cross-jurisdictional portfolios.

Is Process Transparency Your Priority?

If we had to sum up the benefits of a digital approach to asset management, we would do so with a note on streamlining. An intelligent platform improves transparency by streamlining all aspects of management, which leads to a subsequent increase in asset performance.

With the sheer number of stakeholders involved in renewable energy projects, the level of financial and operational transparency pretty much dictates their success. As renewables embrace new changes like going borderless with Virtual Power Purchase Agreements, the need for transparency has become one of the biggest priorities, in particular, for asset owners, executives, and consultants.