Digitalization has been the talk of the town in renewables for quite some time. And as asset management partners, we’ve talked about it a lot from the perspective of efficiency and productivity. A recent report compiled by DNV GL’s Energy Transition Outlook turned our attention to the impact of digitalization on renewable energy investment strategies.

How is this move towards workflow automation and smarter technologies changing the investment landscape in renewables? Given that we want the cleantech industry to be powered by the right technologies, how clearly do these digital investments turn into profitable dollars? Or better yet, how do they shape future investment strategies?

These questions often don’t have straight answers. Well, because energy transition and digitalization are constantly evolving fields.

So, let’s take a deeper dive to understand how digitalization is shaping renewable energy investments in our world today.

Digital Developments That Have an Impact on Renewable Energy Investment Strategies

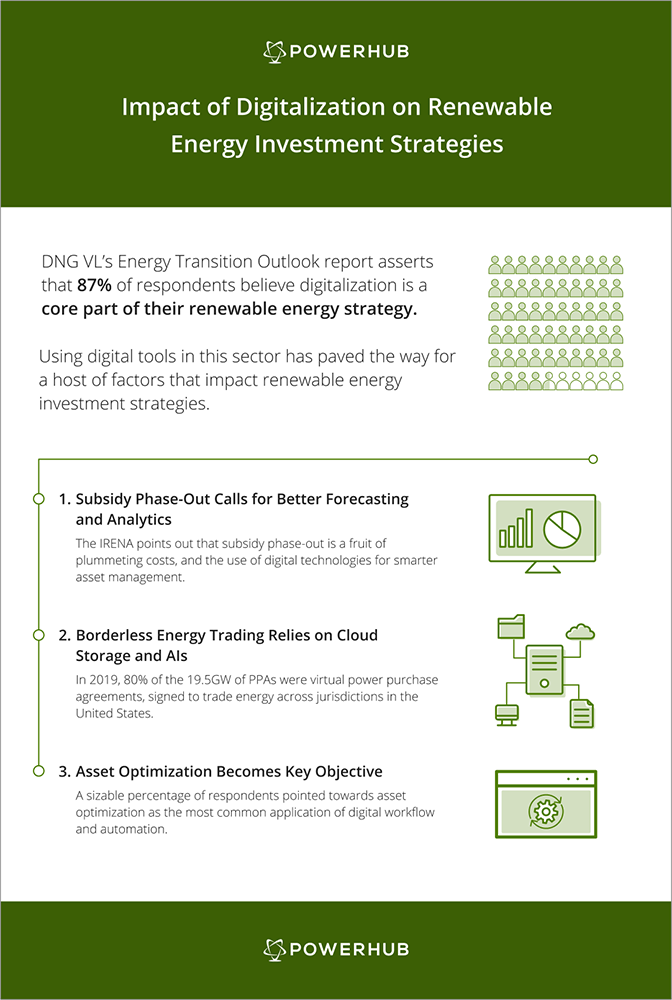

According to DNV GL’s report, 87% of respondents in renewable energy assert that digitalization is a core part of their company’s strategy. Why does that matter? Well, because renewable energy developers are now more open towards digital empowerment to make informed decisions about their investments.

This need to make smarter investment decisions comes at the heels of a number of developments in renewables. We believe the following three advances have had the most profound impact on renewable energy investment strategies.

Subsidy Phase-Out Calls for Better Forecasting and Analytics

As subsidies for renewables phase-out, wind and solar projects will now be exposed to market forces. The International Renewable Energy Agency (IRENA) points out that subsidy independence has been a fruit of plummeting costs and the use of digital technologies for smarter asset management.

So yes, unsubsidized clean power is a win for clean energy. However, it has also translated into a dash by energy investment companies to put in place stronger, more reliable risk assessment systems. Such systems would help keep production predictable and assist in analyzing open market fluctuations.

And how do you get these insights? With a coordinated digital strategy in place. An intelligent renewable energy software is just the starting point of this strategy.

Borderless Energy Trading Relies on Cloud Storage and AIs

The efforts to accelerate energy transition, and decarbonize our world, have resulted in borderless energy trading. In 2019, 80% of the 19.5GW of PPAs were virtual power purchase agreements, signed to trade energy across jurisdictions in the United States.

No longer do renewable energy developers and investors want to be tied down to borders. They want to make investment decisions based on where they can sell electricity most profitability and generate that electricity cheaply.

Consequently, energy asset management companies have played a pivotal role in providing cloud storage technologies. Powered with AIs, these platforms reassure stakeholders of real-time, remote operational controls, thus driving profitable renewable energy investments.

Asset Optimization Becomes Key Objective

From a total of 2000 respondents chosen for the report, a sizable percentage pointed towards asset optimization as the ‘most common application of digital workflow and automation.’

Cloud computing, cyber security, data visualization, and machine learning are top digital functions that have become necessary in strategizing investment decisions and well, dollars.

Moreover, advanced modeling tools have equipped asset managers with virtual technologies. According to the report, 35% of respondents believe blockchain is contributing to process optimization, and thus, has a significant impact on the energy value chain.

As a result of robust partnerships with energy asset management companies, such digital tools have made expensive field testing redundant. Is it disruptive? Yes. However, the benefits as a result of this disruption are exactly what the industry needs to continue making asset optimization a key priority.

Are We Digitally Mature?

It’s safe to say we’re a long way from digital maturity. But we’re definitely on the right path.

Developments in the energy sector that call for a digital transformation are now becoming a norm. Small- and large-scale power suppliers and producers are partnering with energy asset management companies – laying grounds for more companies to jump on the digitalization bandwagon.

This trend also supports another statistic found in the report – 71% of companies in this space are investing heavily in digital skills training. They want their management teams to be abreast with the latest trends in digital automation.