Corporate Power Purchase Agreements is one of my favorite subjects. Ever since the mighty corporations realized their energy mixes needed some pizazz (think: sugar, spice & everything nice), a world of PPAs started to flourish.

With newer guidelines, and a strong shift towards borderless management, Virtual power purchase agreements (VPPAs) have now become the real deal.

We’ve written in depth about traditional corporate PPAs for your reading pleasure on our blog. Before we get into virtual PPAs, let’s recap a few basics here.

Power purchase agreements are contracts between energy buyers and developers. They give a guarantee to the developer that the buyer will purchase power generated from renewable energy assets.

On the other hand, the buyer benefits from a stable, fixed price, and also collects renewable energy credits. These credits, calculated in megawatt hours, further their #gogreen agendas, and help them put their best foot forward in front of investors.

So, are VPPAs any different? What’s their purpose? How do they work? Who buys them? I know you’re full of questions. Let’s get diggin’.

What’s a Virtual Power Purchase Agreement?

A virtual power purchase agreement is a long-term contract between a corporation and a developer. As the name implies, in a virtual power purchase agreement, there’s no physical exchange of energy.

When a corporation signs a VPPA, it agrees to pay a fixed price for each unit of power produced at a wind or solar facility for a settled period. The developer then sells this electricity on the wholesale market. The point of sale is a pre-selected location from where the public can access power produced by renewable energy assets.

Unlike a physical power purchase agreement, a virtual PPA is purely a monetary contract. Which is why, it is also known as a Financial Power Purchase Agreement.

How Does a Virtual Power Purchase Agreement Work?

Let’s break down the working of virtual power purchase agreements into four steps. Start to finish – makes it very simple to understand.

Here goes:

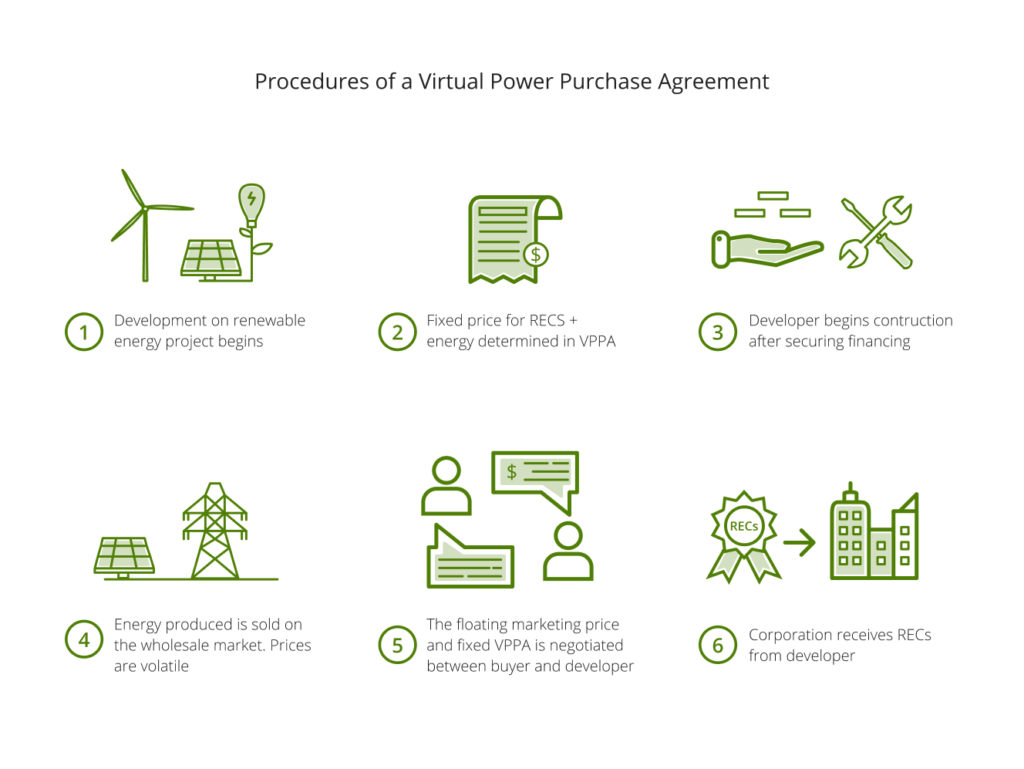

Step 1: A developer decides to build a renewable energy project. He starts the greenfielding phase, i.e. looks into permits, best locations, and grid connections, etc.

Step 2: It is at this stage that the buyer and developer sign the VPPA contract. They agree to all terms and conditions of the agreement for a period of about 10-12 years. With the VPPA, the developer accesses the essential financing needed to build the project.

Step 3: Once constructed, the developer begins selling the energy produced on the power market. Now remember, the corporate buyer has agreed to pay a fixed price for renewable energy, however; the developer (also the seller) is subject to variable market prices.

Step 4: At the end of the settlement period, the developer calculates the difference between market price and contract price. Now, if the renewable energy project made more money on the open market than the pre-determined fixed price on the contract, the developer pays a surplus to the buyer. If not, the buyer pays the difference to the developer.

A virtual power purchase agreement is then a ‘contract for differences’, of sorts. It is signed for the underlying value of energy, not the physical flow of power.

How Do Corporations Benefit From Virtual Power Purchase Agreements?

What’s in it for the corporate buyer, you ask? I get it, they do need something to fuel their bottom line. This is where the concept of ‘hedging’ comes into play. No matter what the prices are on the open market, the buyer always benefits from a fixed rate of power. And hence, is hedged from price volatility.

Moreover, similar to traditional PPAs, virtual power purchase agreements build renewable energy credits for corporations. They receive one Renewable Energy Certificate (REC) from the developer for every megawatt-hour of power produced.

Another aspect that the buyer, and the larger market, benefit from is additionality. This refers to the addition of a new sustainable source of power to the existing grid network.

Thus, virtual power purchase agreements present a great opportunity to develop clean energy projects in newer markets. With the financial backing from giant corporations, raising money for solar plants and wind farms becomes easier, encouraging smaller developers to operate.

What Type of Corporations Can Purchase VPPAs?

Great question. Today, pretty much any entity that classifies as a corporation can buy VPPAs. However, that wasn’t always the case.

Previously, developers preferred selling these contracts to a single corporate giant or utility company. Once a major buyer was secured, any leftover watts were sold to a secondary (and usually smaller) player. Naturally, this approach limited the use of PPAs to the top tier only.

Over the years, these conditions have relaxed. To increase investment in renewable energy, developers now slice up projects to attract multiple corporate buyers. These buyers can decide how much energy they want to invest in.

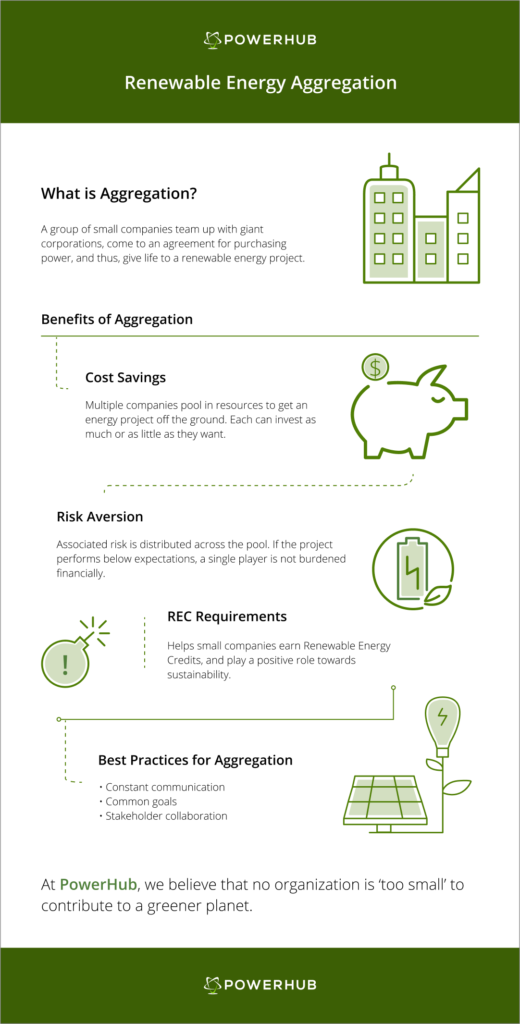

Aggregation is the foundation of such a concept. It allows small scale buyers to team up with giant corporations, come to an agreement for purchasing power, and thus, give life to a renewable energy project.

Now all of this sounds great. But does aggregation present a logistical challenge? I’d say yes, but it’s one that can be mitigated with a strong focus on digitalization. Managing multiple buyers, their contracts, contributions, and payouts can be streamlined if a robust, cloud-based asset management platform is leveraged.

Yes, I know – you’ve heard me say this before. I can’t help it; intelligent software really is the backbone of successful energy management.

Are Virtual Power Purchase Agreements Transformational?

Yes, absolutely. Virtual power purchase agreements have transformed the clean energy space. Like I mentioned above, they have opened doors to smaller corporations that previously thought only the Googles, Amazons, and Microsofts of the world had the muscle to take the carbon offset challenge.

I’d divide the impact of VPPAs into the two biggest benefits: Sustainability & Borderless Management.

Making our planet, and our energy sources, sustainable has accelerated with the use of virtual power purchase agreements. 2018 was a record year in the United States for renewable energy contracts. 4.81 GW of virtual agreements were signed within the first 10 months.

And borderless? Well, that’s everything these days. You don’t want to be restricted to any particular geography. To purchase a virtual agreement, the corporation doesn’t need to be physically located in the same jurisdiction as the electricity market. As long as the power is being sold to a deregulated network, VPPAs let you be truly virtual.

Hence, not only does a virtual agreement open doors to more opportunities, it also makes management of assets and contracts easier. Moreover, with the fixed price component, buyers need not worry about market volatility. That’s what VPPAs empower corporations with.

Are Virtual PPAs Your Thing?

Corporate buyers are responsible for more than 50% of renewable energy asset contracting. They are an essential player in turning clean power into a mainstream commodity in some of the biggest economies of the world.

Which is why, the push for virtual power purchase agreements has predominantly come from corporations who may not have extensive renewable energy trading experience.

Consequently, VPPAs encourage them to contribute to getting a new wind or solar project off the ground, and meet their own sustainability goals as well.

As we always assert at PowerHub, the benefits of going virtual are, and always should be, reaped by all.