There’s a future where solar energy is an option. And there’s a future where reliable and consistent solar power is a looming possibility. The difference in both? The use of data and insights that optimize asset management for solar energy. It’s a simple, yet powerful difference.

Compiling information from satellites, weather analysis, machine learning, and powerful system integrations can help optimize asset management for solar energy in two ways.

First, it helps lower the cost of energy produced with a string of solar panels. Come 2021, we’re already talking about indulging in one-cent solar power, and free residential panel setups in Italian regions that receive ample sunlight. Imagine the cost efficiencies we can generate further with intelligent number crunching!

Moreover, optimizing asset management for solar energy will help pave the way for renewables into new markets. In 2019 alone, the global Solar PV market grew by 12% to 115GWs, with strong demand in emerging markets.

Some 10 years back, the same number was less than 23GWs in total. So, how is big data and analytics changing the asset management landscape for solar energy?

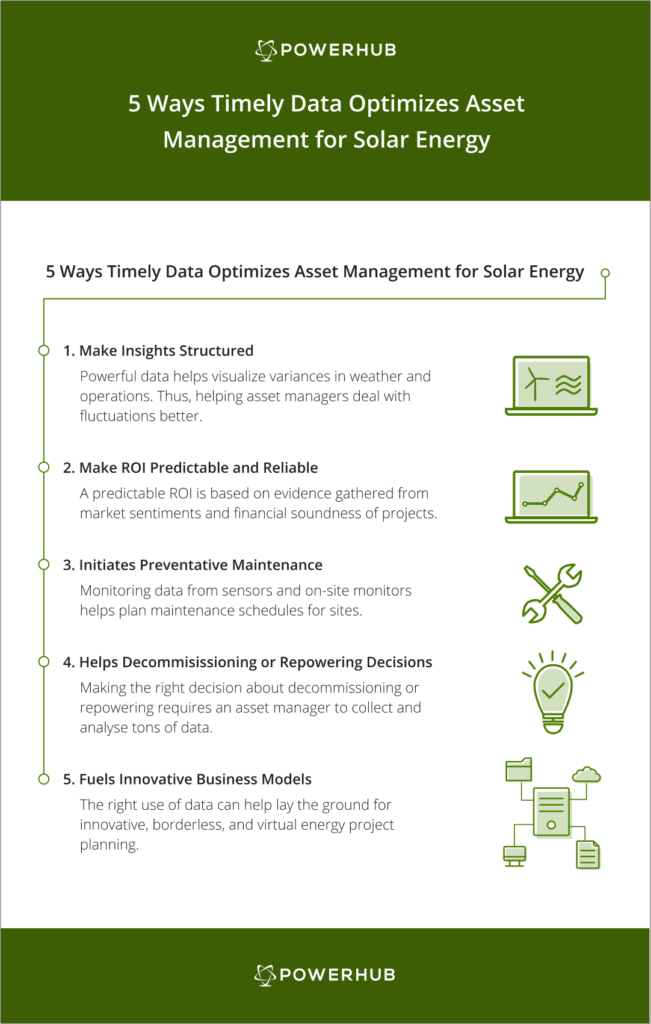

Making Insights Structured

There’s nothing solar PV experts dislike more than uncertainty. So, anything that tames the intermittent nature of solar energy is always a big thumbs up for the industry. Big data and sound analytics are a few of those elements.

Data patterns are important. Breaking them down is even more important. Knowledge drawn from weather and operational visualizations can help utilities and energy providers manage variations in the grid. They can predict the amount of power that will be generated, and lay down asset management optimization strategies for solar energy.

Making ROI Predictable and Reliable

The scope of investments in solar, and renewables in general, is widening. There are more investors, developers, and asset owners involved in complex, hybrid projects. Hence, the need to monitor returns on investments is paramount.

Data can help with ROI in two ways. One, it keeps track of performance output ratios in relation to investment figures. And second, it can also help understand customer needs, buying patterns, and #gogreen sentiments better.

At the end of the day, a net zero and majority renewables shift will be driven by market demand, and a strong sentiment towards saving the planet. Backing these trends with measurable insights is a great way to lay a solid foundation for a clean energy future.

Initiating Preventative Maintenance

Maintaining solar farms with thousands of panels stretching across acres of land can be an expensive and time-consuming process. Not to mention, it requires O&M teams to be extremely coordinated and meticulous in logistical operations to minimize any disruptions to panel setups.

Moreover, the geographically dispersed nature of solar plants always makes it harder to have large maintenance crews in a centralized location.

Hence, regularly monitoring data from sensors and loggers can pinpoint problems like below-par performance because of dirt accumulation, for instance. And timely action can optimize solar PV management, helping renewables become the fuel of the future.

Helping Decommissioning or Repowering Decisions

As the world’s first generation solar and wind farms near the end of their useful life, the decision to decommission or repower is becoming an asset management priority. And to do so, an asset manager needs powerful data and accurate information more than anything else.

Making the right decision requires a thorough analysis of ongoing maintenance costs, productivity, operational inefficiencies, and future projections. Using big data analytics on a smart solar PV management software can help with this crucial decision.

It can highlight and visualize patterns that may support a repowering decision for the site, or favor decommissioning to maintain healthy ROIs.

Fueling Innovative Business Models

Today, as virtual power purchase agreements proliferate the solar industry, it helps to look back at the information and insights used to develop such an innovative business model. It was because of robust data analytics that renewable energy experts were able to optimize asset management for solar energy in ways that facilitate dispersed, virtual trading.

Therefore, beyond the scope of current plants and projects, the right use of the right data can help grow the renewables industry beyond its current scope, markets and models.

Which Future Is Our Reality?

Thanks to incremental advances in technology, renewable energy can now have a future that relies on valuable and concrete information. Therefore, organizations are increasingly using innovative ways to track and monitor data to solve operational issues in the solar industry.

And the starting point of this journey to optimize asset management for solar energy? Cultivating a digital mindset amongst teams and embracing new ways to fulfill daily management tasks.

A streamlined onboarding process on a smart platform like PowerHub is the best way to get buy-in and promote the benefits of powerful data.